We see many purchasers of BTL property unaware of the proposed EPC changes .

Background to Changes

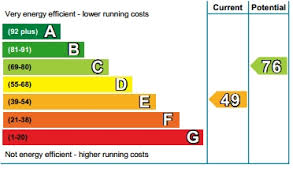

The government proposed in December 2020 that all rental properties must have an EPC rating of ‘C’ or above by 2025. All tenancies will have to comply with this regulation by 2028.

Renting out a property with an EPC rating lower than a ‘C’ will be illegal if the proposal becomes law.

What can you do

If landlords take out a BTL Mortgage on a five-year fix and need to sell the property, they may incur an early repayment penalty.

Additionally, they should consider the cost of making the necessary changes to reach the required standard if they decide to keep the property.

If you look at the EPC report it will make suggestions to improve the rating. For instance, they can switch to LED light bulbs, which are more energy-efficient and eco-friendly.

Other techniques include installing double-glazed windows, smart meters, energy-efficient boilers, wall and roof insulation.

It is advisable to talk to an EPC assessor to discuss what can be done and the potential costs involved.

Furthermore, landlords can look up their neighbours’ EPC ratings to see how they achieved a ‘C’ rating.

Although the deadline for compliance is still a few years away, landlords have an incentive to start the work early due to the shortage of skilled labour in the market.

Mortgage Implications

Landlords should also consider their exit strategies and remortgage with green BTL mortgages that offer lower rates or fees to those with energy-efficient properties.

If you need help arranging your BTL Mortgage, please contact us.